October 12, 2010

Sustainable Investor Co. Providing Financing to Make the Earth Healthy, People Happy

Keywords: Newsletter

JFS Newsletter No.97 (September 2010)

"Towards a Sustainable Japan -- Corporations at Work" (No. 95)

https://www.sustainable-investor.co.jp/si/

Copyright Sustainable Investor Co.

Facing the moat surrounding the Imperial Palace in central Tokyo is the Kagura Building, an example of modern architecture where natural lighting and green features comfortably brighten up concrete walls and wood floors. Sustainable Investor Co. (SI) has its office in this building, combined with a gallery and an events hall. With the aim of shifting financial flows towards a more sustainable society, SI has been working on developing its "Eco Value Up Fund" and "Forest Fund," and providing financial advice to individuals as a private bank or consulting to companies. It delivers its innovative financial ideas to Japanese society from this building.

Hiderou Okuyama and Shin Takizawa, who both once worked at major financial institutions, established SI in 2006. It has been four years since they launched it with the lofty vision of sustaining the circulation of money in society based on real value. Following is an interview with Takizawa, one of SI's executive partners.

Starting Up a New Business to Support a Sustainable Society

In 1997, when the Kyoto Protocol was adopted and the issue of global warming was beginning to attract more attention around the world, Takizawa visited Muhammad Yunus in Bangladesh. Yunus is a Nobel Peace Prize Laureate and founder of the Grameen Bank, which was established for the purpose of helping the poor live more independently. Takizawa says Yunus told him that business and social action can be compatible, and that we should take a tough stance on environmental issues and work for the real benefit of people and society. His words had a strong impact on Takizawa, who was frustrated with the situation in Japan where even young kids don't dare pursue their own dreams in an affluent capitalistic economy. Takizawa also received an assignment from him. Muhammad Yunus said: "I could do this in Bangladesh, one of the poorest countries. There is no reason that you can't do this in Japan. Try to start some action to help society when you go back."

The first "eco-fund" was launched in Japan in 1999. At present, some 90 socially responsible investment (SRI) funds are on the market; however, the scale of the Japanese SRI market in 2007 was only about 850 billion yen (about US$7.5 billion). Compared to the market scale of $2.711 trillion (about 306 trillion yen) in the U.S., or 2.6654 trillion euros (about 344 trillion yen) in Europe, the scale of the Japanese market is actually very small.

Social Investment Forum Japan

http://www.sifjapan.org/english/index.html

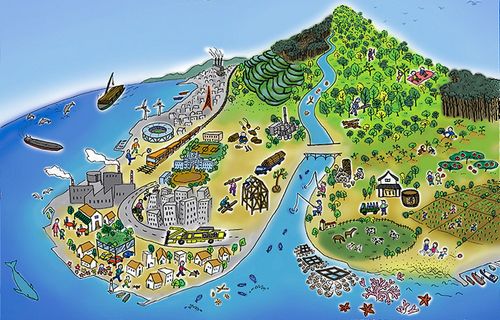

SI was launched under this financial situation. A company brochure shows the SI vision for a sustainable society, depicting the oceans, mountains, rivers, farms, factories, and homes, as well as vivacious people and animals, and healthy-looking plants. Natural ecosystems are shown in harmony with urban living. To aid in the creation of such a sustainable society, the company has brought two funds onto the market: the "Eco Value Up Fund" and the "Forest Fund."

The Eco Value Up Fund is for businesses with a desire to work promote harmony between the environment and the economy. Targeted companies include small and medium-sized companies whose stocks are often undervalued not covered by traditional eco-funds. Investors in the fund become stakeholders as cooperative members, and can help change the actions of the companies by sending in comments and joining discussions via SI's blog.

Revitalizing Japanese Forests through a Forest Restoration Program

The other fund is the Forest Fund. The idea of this fund came about when Takizawa became aware of the state of Japanese forestry while talking with members of a wood industry cooperative. He thought about what the financial industry could do to improve the situation.

Japan is rich in forests. About 70 percent (25,120,000 hectares) of its total land area (37,790,000 hectares) is forested, with half of that purposely planted with trees such as Japanese cedar and Japanese cypress. This is because after World War II, the traditional Japanese forests such as those in "satoyama" (traditional community forests near villages) and natural forests deep in the mountains were replaced with conifer forests, due to the government's expansive afforestation policy as part of postwar restoration. However, there is little demand for local construction materials anymore, and the Japanese forest industry is on the decline due to competition from cheap imported timber. Thus, many manmade forests in Japan are in poor condition because of the lack of proper management and care.

Planting more trees may not be the solution. Forests need sustained management and care over a long period of time after the trees are first planted. To do so means covering costs corresponding to the period, requiring a stable and continuous scheme to cover them. With the SI's Forest Fund, half of the fund (100,000 yen, or about $850 per share) is spent to purchase forest land, and the other half is used to purchase high-yield foreign bonds and others instruments to secure stable financial performance from its yields and dividends to use for forest restoration.

Forests are essential to human life. They provide us with drinking water, nutrients for fish in the ocean, and oxygen for living organisms -- for all of these, forests are essential. One Japanese study found that 15 trees are needed to absorb the CO2 the average person exhales in a year just by breathing, and 376 trees are needed to absorb all the CO2 emitted as a result of the average Japanese person's lifestyle. Thus, forest protection is essential for a sustainable society and for each of us.

The company gained the support of many people by holding seminars across Japan to explain this background in detail. Many were concerned about forests, and it was a new way of investment for them. It collected 73 million yen (about $820,000) from 84 investors, including company executives, university professors, lawyers, students, and housewives. With this money, SI purchased 18 hectares of mountain forest in Mitomi, Yamanashi Prefecture, and ten hectares in Hinohara-mura, Tokyo. It takes from 50 to 100 years to grow a forest to maturity, but the fund provides an opportunity of redemption by setting 2020 as the maturity date.

In May 2009, SI held a tree-planting event with investors in Mitomi, Yamanashi Prefecture. Some of the participants were families with elementary school children. They were able to experience working the soil and planting the Japanese cypress seedlings themselves, giving participants a real sense of investment in the forest.

Takizawa expressed his feelings about the Forest Fund as, "We just happened to use the financial system of funding, but any system may have been OK, as long as we can preserve forests. When we hear the word 'fund,' we tend to have an image of a financial product that emphasizes risk and return. But what we would like to aim at is maintaining the circulation of money based on the real value of forests."

Wanted: Network of Two Million Intellectually Rich People

Takizawa says, "We need two million intellectually rich people" to diffuse this idea. They may not necessarily be financially rich, but "rich" on an intellectual curiosity level. Takizawa emphasized that, "In Japan, I believe many people have the potential to be intellectually rich. But when I look at how people spend their money, only a few are able to invest at their own risk. I hope each will have a concrete vision about an ideal future, and choose projects to invest in proactively, instead of just saving their money in the banks. If we can create two million investors and support the network, then society will change greatly."

According to the "Diffusion of Innovations" theory invented by Everett M. Rogers, innovation will occur if 2.5 percent of the whole changes. The target of creating two million intellectually rich people seems to be the first step for social innovation, considering that the population of Japan is 130 million.

The company is developing a new financial plan for projects to restore agricultural land following the forest restoration project. In the future, JFS hopes to see new projects that help more people to become actively involved and become familiar with the movement toward a sustainable society.

Written by Taeko Ohno

See also: Proactive Investing to Promote Sustainability - Sustainable Investor Co., Ltd.

http://www.japanfs.org/en/mailmagazine/newsletter/pages/027912.html

Related

"JFS Newsletter"

- 'Good Companies in Japan' (Article No.4): 'Eightfold Satisfaction' Management for Everyone's Happiness

- "Nai-Mono-Wa-Nai": Ama Town's Concept of Sufficiency and Message to the World

- 'Yumekaze' Wind Turbine Project Connects Metro Consumers and Regional Producers: Seikatsu Club Consumers' Co-operative

- Shaping Japan's Energy toward 2050 Participating in the Round Table for Studying Energy Situations

- 'Good Companies in Japan' (Article No.3): Seeking Ways to Develop Societal Contribution along with Core Businesses